Fiscal Calendar: July 1, 2025 – June 30, 2026

Related Articles: Fiscal Calendar: July 1, 2025 – June 30, 2026

- Indian Calendar 2025 With Holidays

- 2025 Tamil Calendar Holidays

- Lunar Calendar 2025 Chinese: A Comprehensive Guide

- Countryfile Calendar 2025: A Stunning Celebration Of The British Countryside

- Indonesia Holiday Calendar 2025: A Comprehensive Guide To Public Holidays

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Fiscal Calendar: July 1, 2025 – June 30, 2026. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Fiscal Calendar: July 1, 2025 – June 30, 2026

Fiscal Calendar: July 1, 2025 – June 30, 2026

Introduction

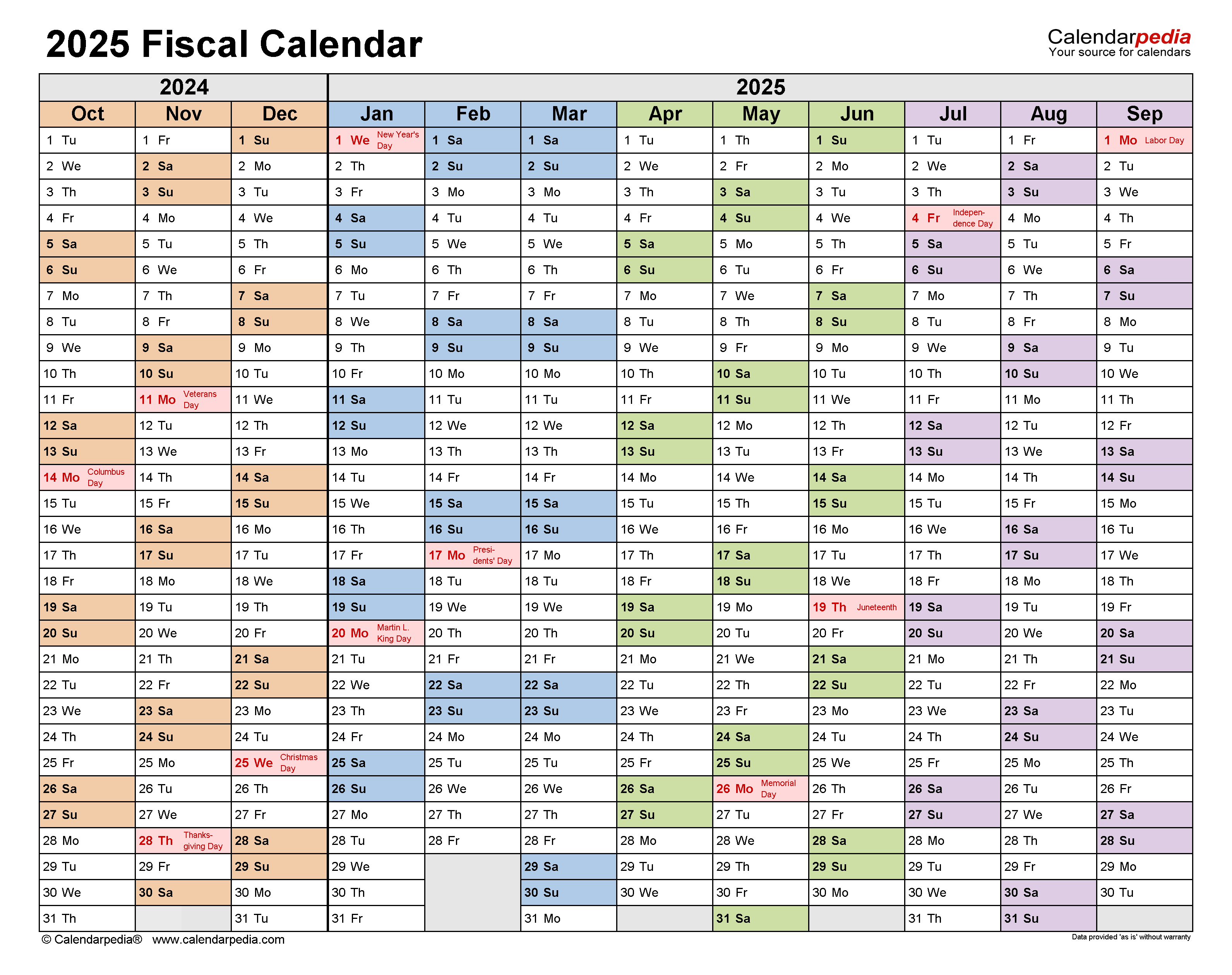

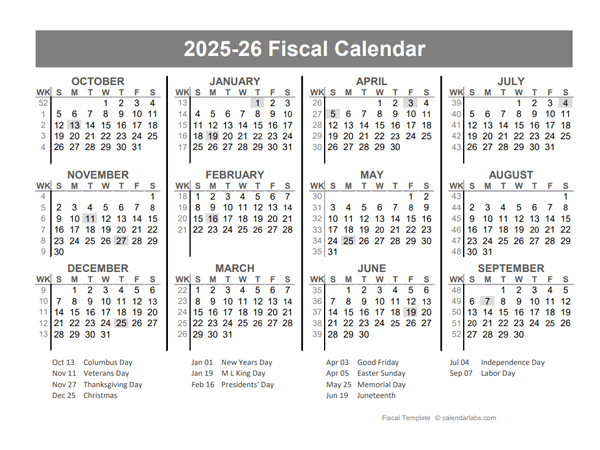

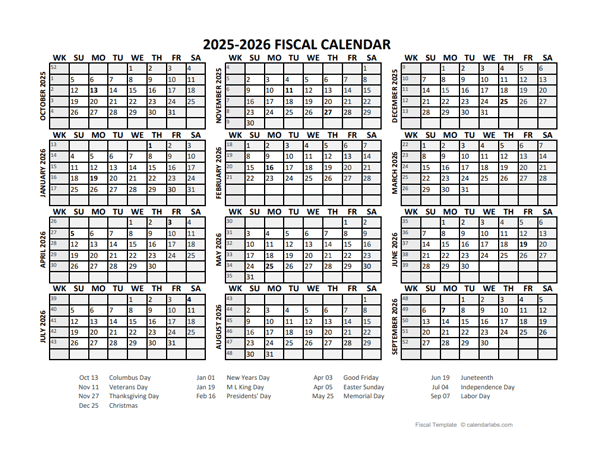

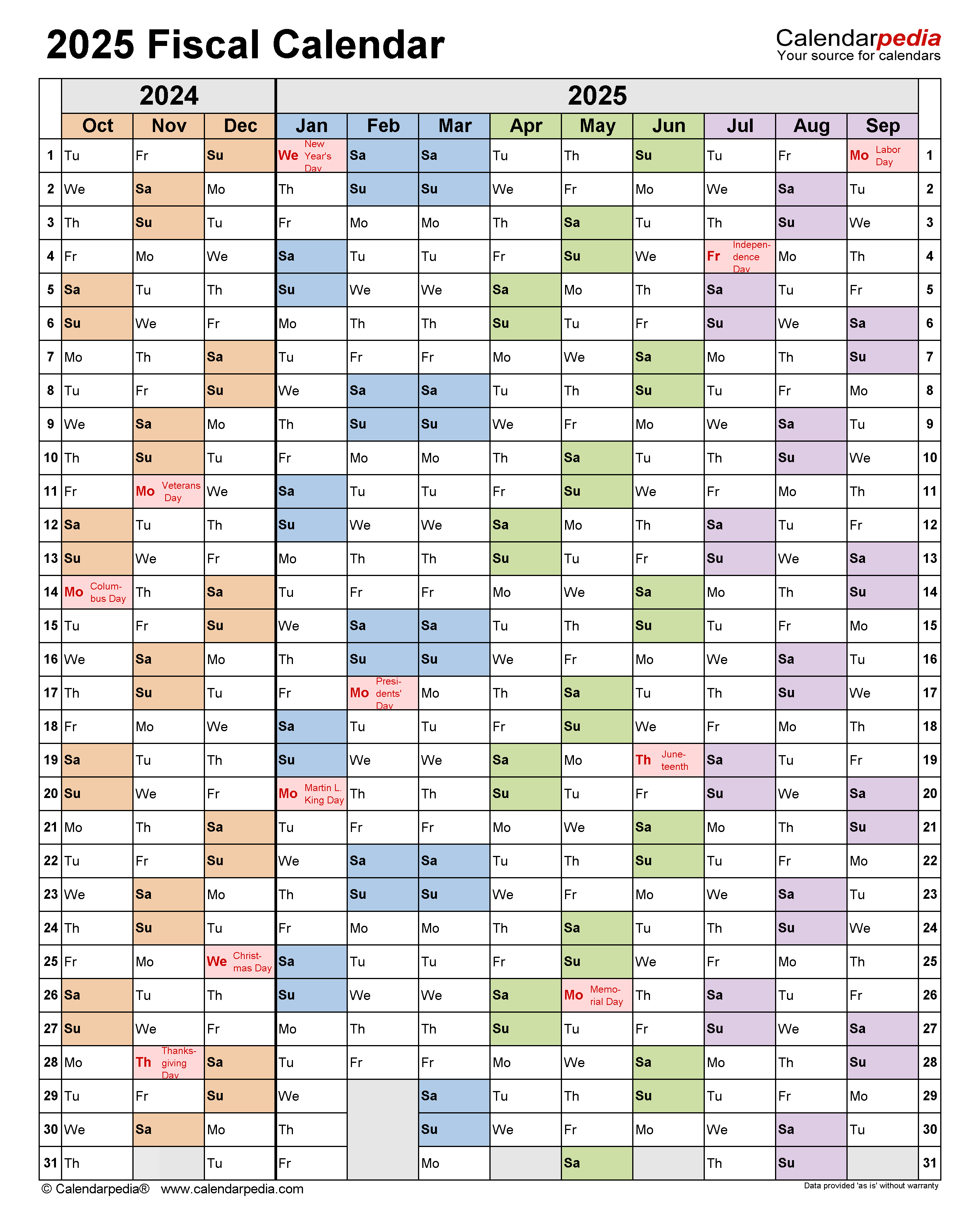

The fiscal calendar is a financial reporting framework that establishes the specific dates for recording and reporting financial transactions within an organization. It provides a consistent and standardized approach to financial reporting, ensuring that all transactions are accurately and consistently recorded and reported. The fiscal calendar is particularly important for organizations that operate across multiple jurisdictions, as it ensures that they comply with the financial reporting requirements of each jurisdiction.

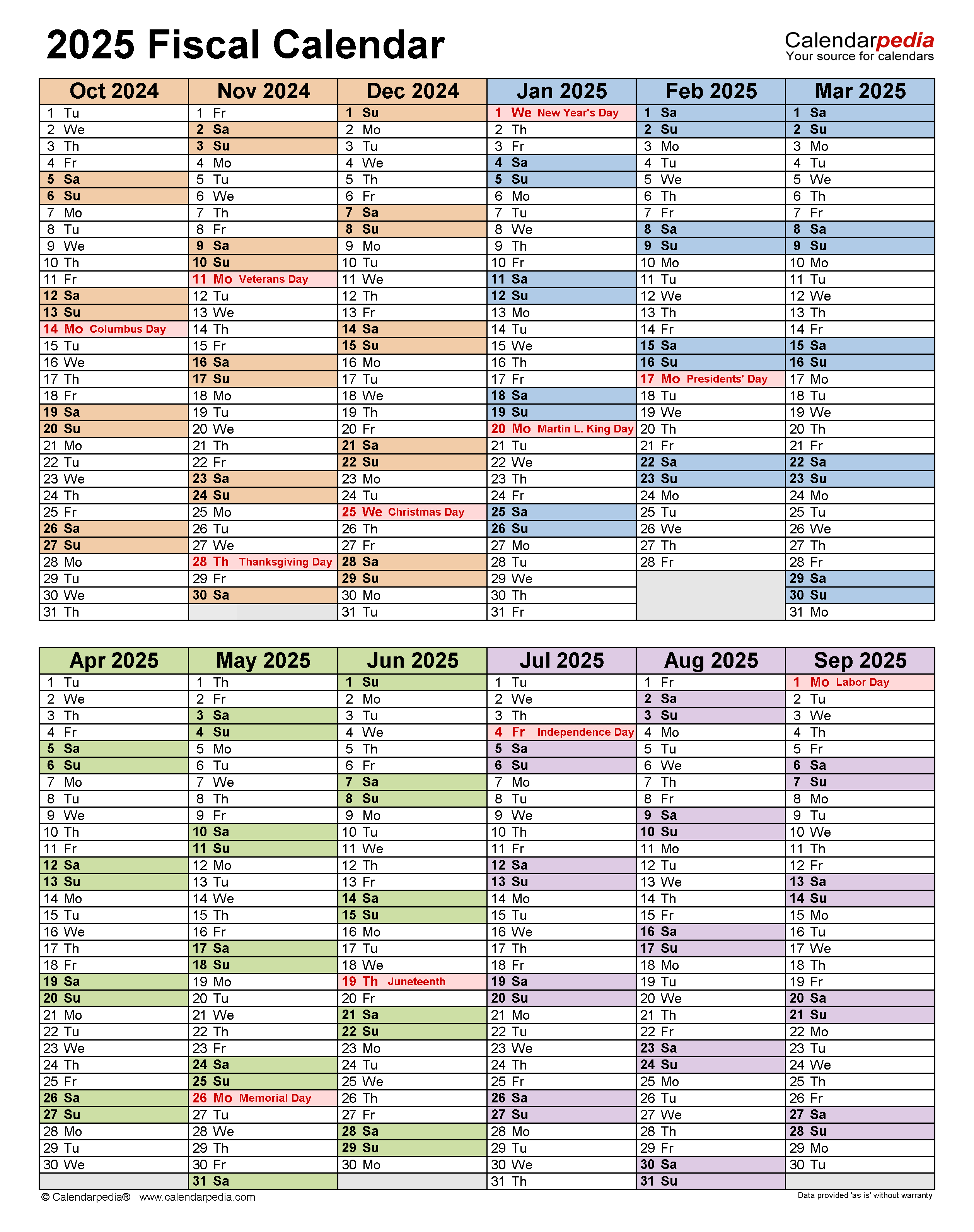

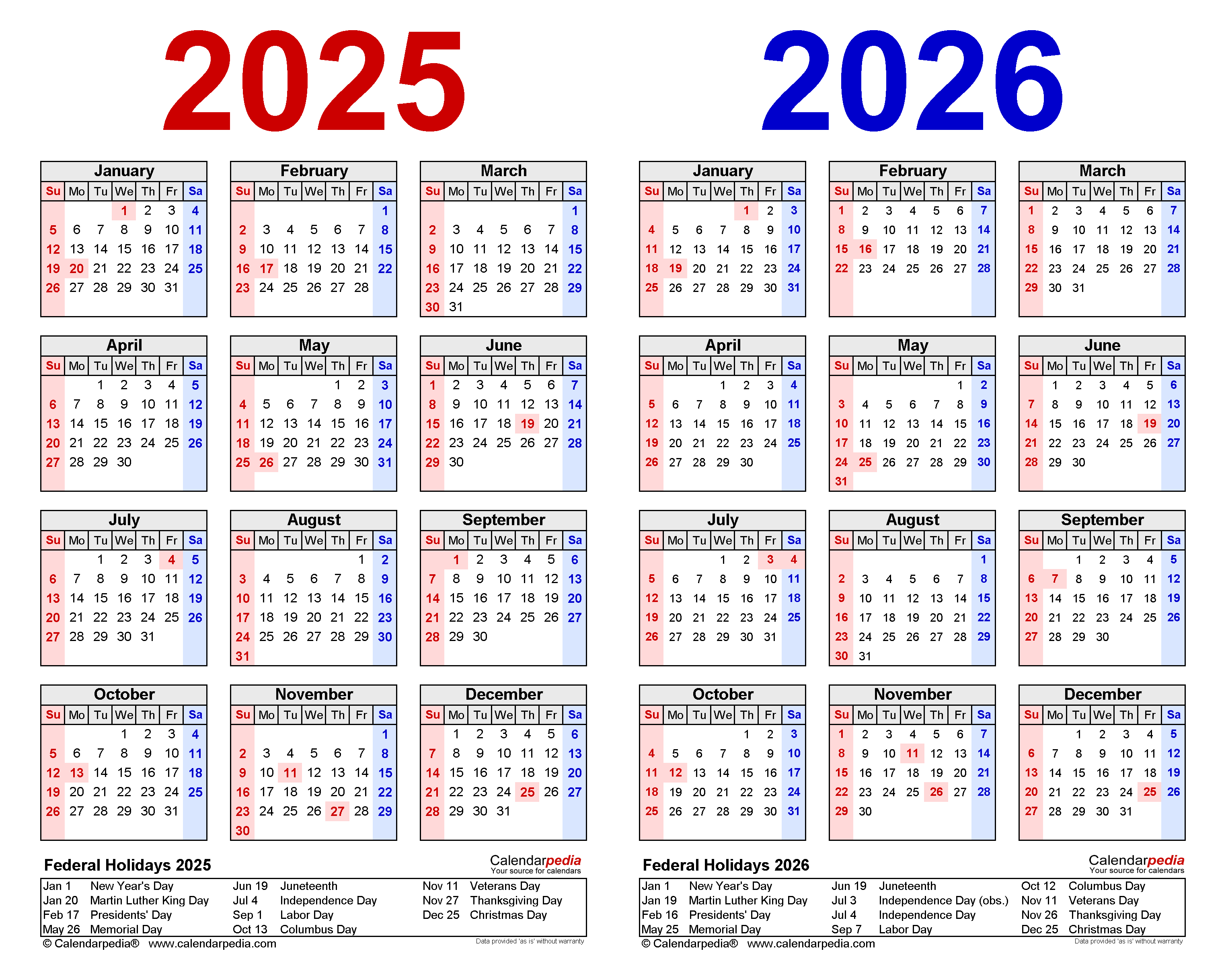

Key Dates

The fiscal calendar for July 1, 2025, to June 30, 2026, includes the following key dates:

- July 1, 2025: Start of the fiscal year

- June 30, 2026: End of the fiscal year

- September 30, 2025: First quarter end

- December 31, 2025: Half-year end

- March 31, 2026: Third quarter end

Financial Reporting Deadlines

The fiscal calendar also establishes the deadlines for submitting financial reports to relevant regulatory bodies and stakeholders. These deadlines are typically based on the end of the fiscal quarter or fiscal year. The following are the financial reporting deadlines for the fiscal year ending June 30, 2026:

- First quarter (September 30, 2025): Financial statements must be filed within 45 days of the quarter-end (November 14, 2025)

- Half-year (December 31, 2025): Financial statements must be filed within 60 days of the half-year end (February 28, 2026)

- Third quarter (March 31, 2026): Financial statements must be filed within 45 days of the quarter-end (May 15, 2026)

- Year-end (June 30, 2026): Financial statements must be filed within 90 days of the year-end (September 28, 2026)

Tax Filing Deadlines

In addition to financial reporting deadlines, the fiscal calendar also includes important tax filing deadlines. These deadlines are typically set by the relevant tax authorities and vary depending on the jurisdiction. It is essential for organizations to be aware of the tax filing deadlines in each jurisdiction in which they operate to ensure timely and accurate tax compliance.

Benefits of a Fiscal Calendar

Implementing a fiscal calendar provides numerous benefits for organizations, including:

- Enhanced financial reporting: A fiscal calendar ensures that financial transactions are recorded and reported consistently and accurately, leading to more reliable and transparent financial statements.

- Improved compliance: By adhering to the deadlines established in the fiscal calendar, organizations can avoid penalties and fines for late or inaccurate financial reporting and tax filings.

- Streamlined operations: A fiscal calendar provides a clear and organized framework for financial reporting and tax compliance, which can streamline operations and reduce the risk of errors.

- Improved decision-making: Accurate and timely financial reporting allows management to make informed decisions based on the latest financial data.

Considerations for Fiscal Calendar Selection

When selecting a fiscal calendar, organizations should consider the following factors:

- Business cycle: The fiscal calendar should align with the organization’s business cycle to ensure that financial reporting and tax filings are synchronized with the natural flow of business activities.

- Regulatory requirements: Organizations must comply with the financial reporting and tax filing requirements of each jurisdiction in which they operate. The fiscal calendar should be selected to meet these requirements.

- Industry practices: It is often beneficial to align the fiscal calendar with industry practices to facilitate comparisons with peers and industry benchmarks.

- Administrative efficiency: The fiscal calendar should be easy to implement and administer, with clear and concise deadlines for financial reporting and tax filings.

Conclusion

A well-defined and properly implemented fiscal calendar is essential for effective financial reporting and tax compliance. By adhering to the key dates and deadlines established in the fiscal calendar, organizations can ensure the accuracy, transparency, and reliability of their financial reporting, while also minimizing the risk of penalties and fines for late or inaccurate filings.

Closure

Thus, we hope this article has provided valuable insights into Fiscal Calendar: July 1, 2025 – June 30, 2026. We appreciate your attention to our article. See you in our next article!