Fiscal Year Calendar: July 2025 – June 2026

Related Articles: Fiscal Year Calendar: July 2025 – June 2026

- F1 2025 Calendar Download: A Comprehensive Guide To The Upcoming Season

- U Of L 2025 Academic Calendar: A Comprehensive Overview

- Wiki Calendar: January 2025

- December 2025 To January 2025 Calendar: A Comprehensive Overview

- Virginia Lottery 2025 Calendar

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Fiscal Year Calendar: July 2025 – June 2026. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Fiscal Year Calendar: July 2025 – June 2026

Fiscal Year Calendar: July 2025 – June 2026

Introduction

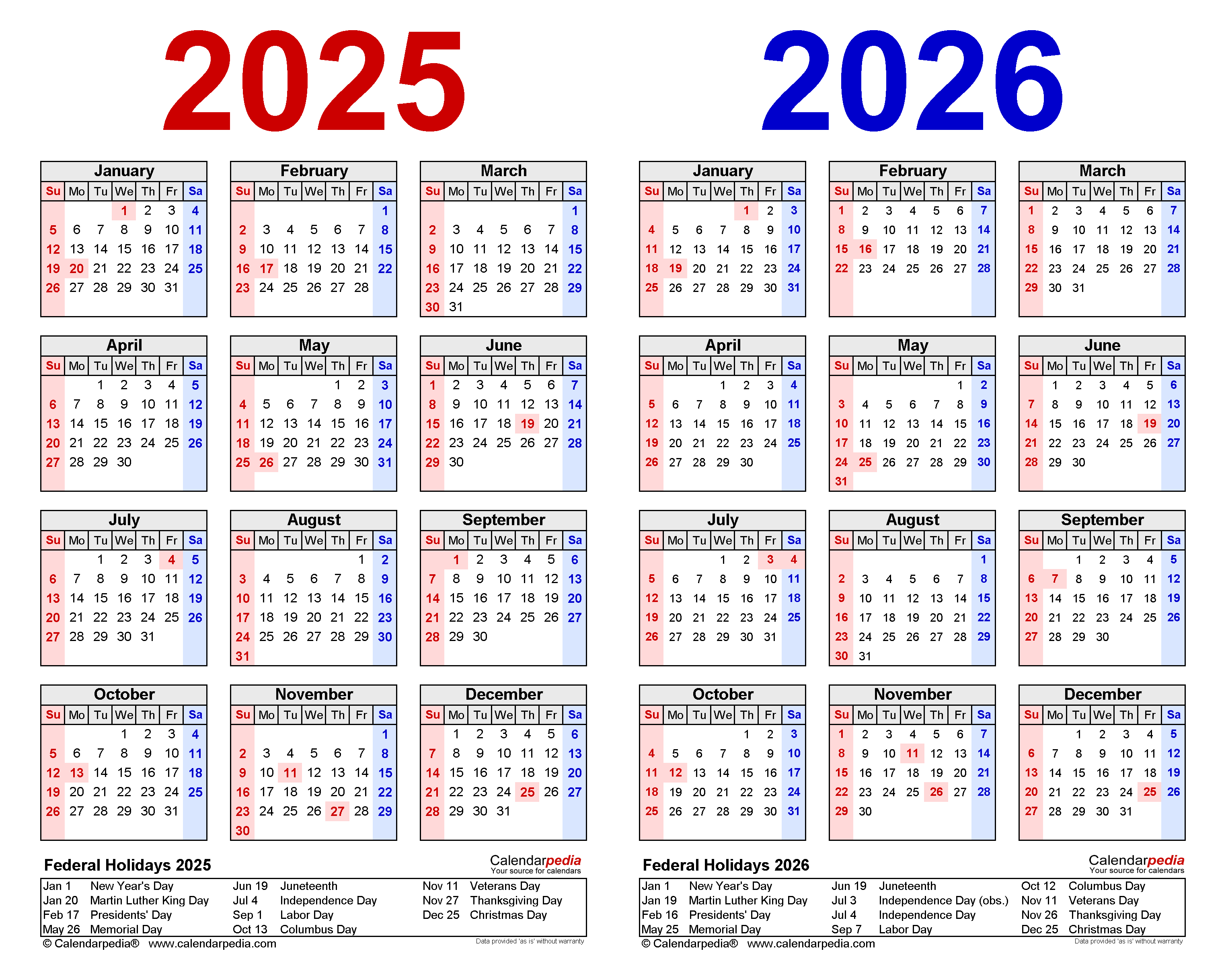

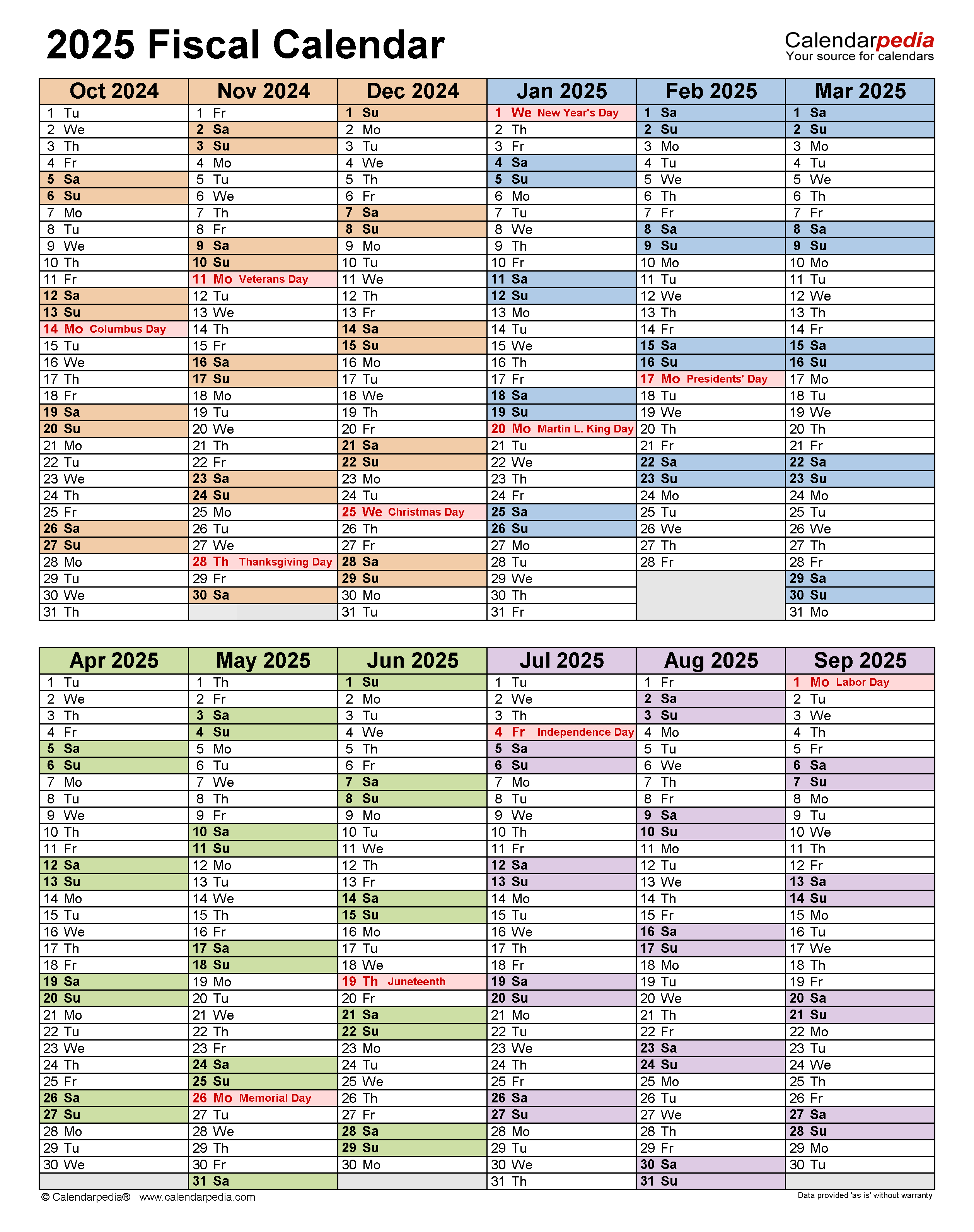

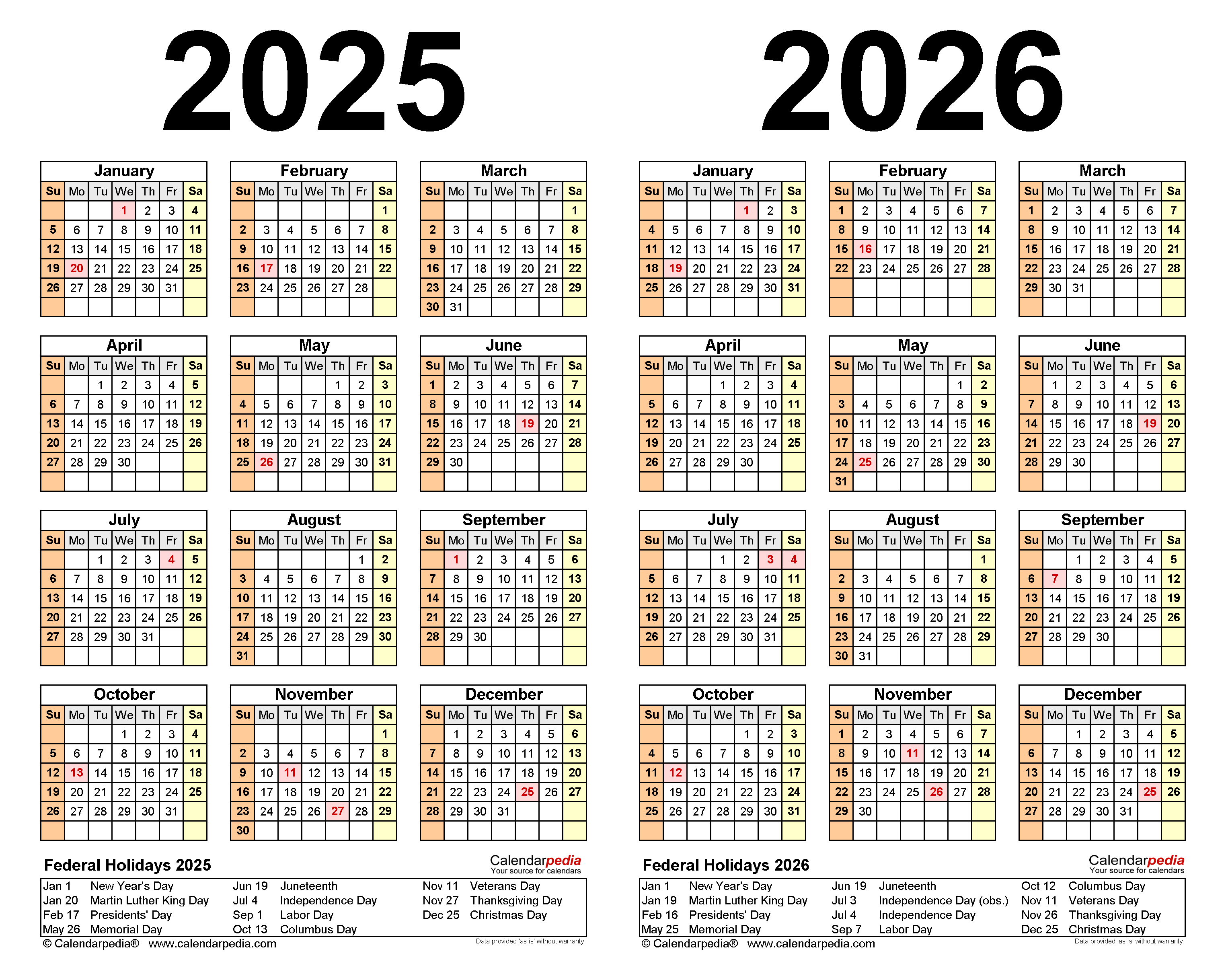

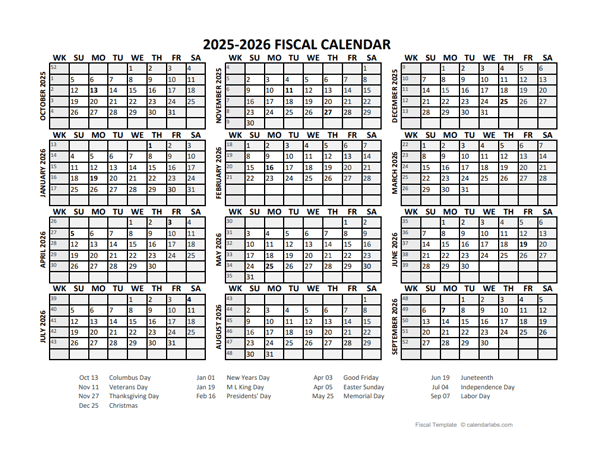

A fiscal year calendar is a financial reporting period that aligns with the business’s natural operating cycle. It serves as a framework for financial planning, budgeting, and reporting. Organizations typically select a fiscal year that aligns with their industry practices, regulatory requirements, and internal operations.

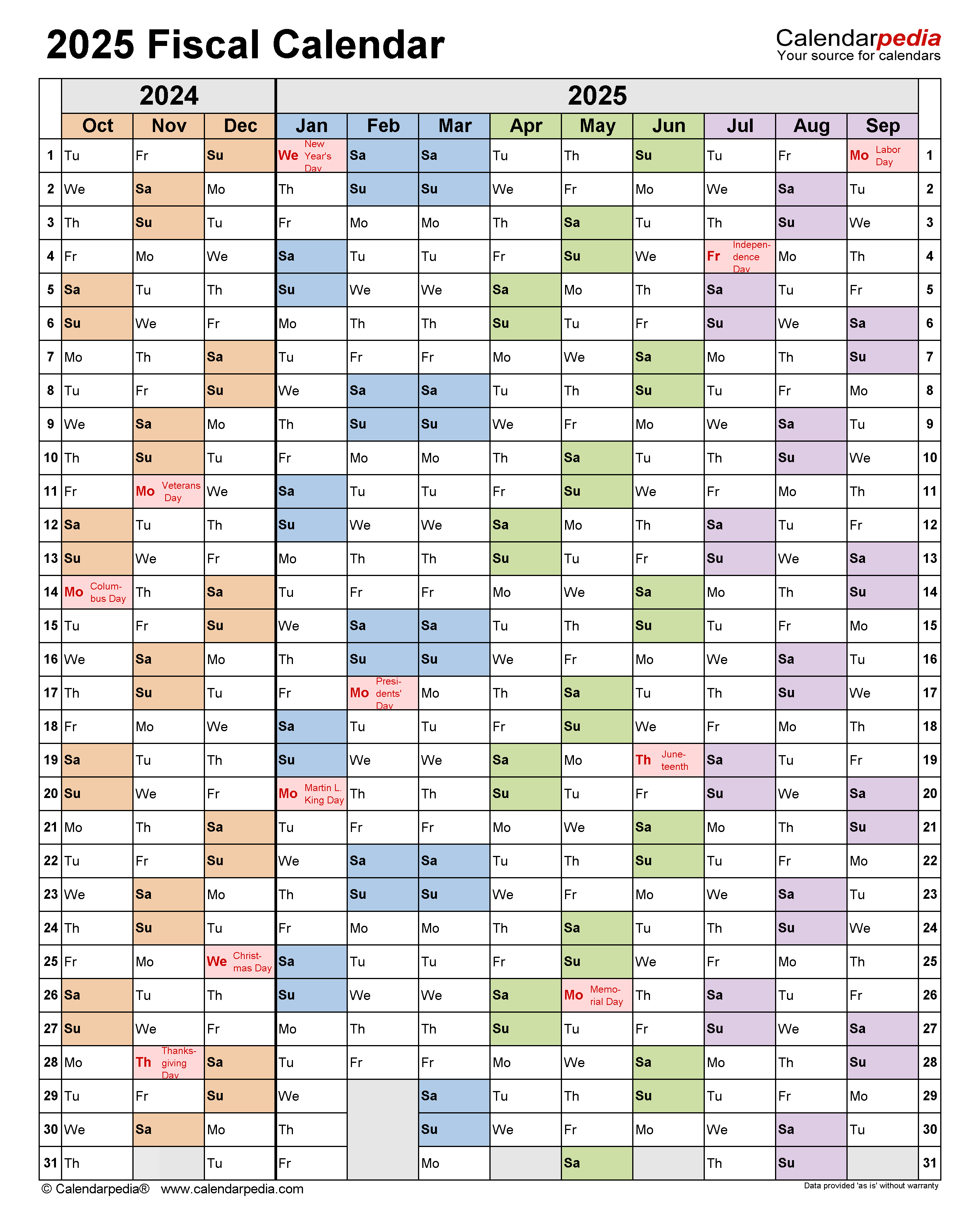

This article presents a fiscal year calendar for the period July 2025 – June 2026. This calendar is based on a 12-month fiscal year that begins on July 1, 2025, and ends on June 30, 2026.

Fiscal Year Calendar: July 2025 – June 2026

| Month | Days |

|---|---|

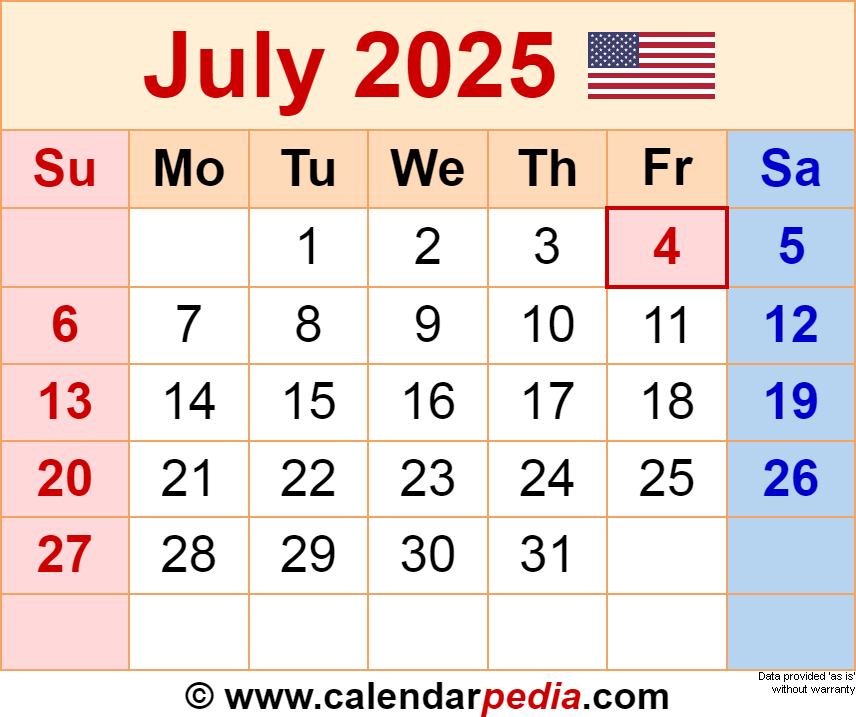

| July 2025 | 31 |

| August 2025 | 31 |

| September 2025 | 30 |

| October 2025 | 31 |

| November 2025 | 30 |

| December 2025 | 31 |

| January 2026 | 31 |

| February 2026 | 28 |

| March 2026 | 31 |

| April 2026 | 30 |

| May 2026 | 31 |

| June 2026 | 30 |

Key Dates

- Start of Fiscal Year: July 1, 2025

- End of Fiscal Year: June 30, 2026

- First Quarter End: September 30, 2025

- Half Year End: December 31, 2025

- Third Quarter End: March 31, 2026

- Fourth Quarter End: June 30, 2026

Benefits of a Fiscal Year Calendar

- Alignment with Business Cycle: A fiscal year calendar can be tailored to match the natural operating cycle of a business. This allows organizations to better track their financial performance and make informed decisions based on seasonal or cyclical trends.

- Improved Financial Planning: A well-defined fiscal year calendar provides a clear framework for financial planning and budgeting. Organizations can use this calendar to forecast revenue, expenses, and cash flow more effectively.

- Enhanced Financial Reporting: A fiscal year calendar ensures that financial statements are prepared and reported on a consistent basis. This facilitates comparisons over time and provides stakeholders with a clear understanding of the organization’s financial performance.

- Regulatory Compliance: Some industries or jurisdictions may have specific requirements for fiscal year reporting. A fiscal year calendar helps organizations comply with these regulations and avoid potential penalties.

- Internal Operations: A fiscal year calendar can be used to align internal operations, such as payroll, inventory management, and capital budgeting, with the financial reporting cycle.

Considerations

When selecting a fiscal year calendar, organizations should consider the following factors:

- Industry Practices: The fiscal year calendar should align with industry standards and best practices.

- Regulatory Requirements: Some industries may have specific fiscal year reporting requirements.

- Internal Operations: The calendar should be compatible with the organization’s internal operations and reporting systems.

- Seasonal or Cyclical Trends: The calendar should consider seasonal or cyclical trends that may impact the organization’s financial performance.

- Tax Considerations: In some cases, the fiscal year calendar may affect tax planning and reporting.

Conclusion

A fiscal year calendar is a valuable tool for financial planning, budgeting, and reporting. By carefully selecting a calendar that aligns with the business’s natural operating cycle and meets regulatory requirements, organizations can improve their financial management and stakeholder communication. The fiscal year calendar for July 2025 – June 2026, presented in this article, provides a framework for organizations to track their financial performance and make informed decisions throughout the fiscal year.

Closure

Thus, we hope this article has provided valuable insights into Fiscal Year Calendar: July 2025 – June 2026. We appreciate your attention to our article. See you in our next article!