Fiscal Year Calendar: July 2025 to June 2026

Related Articles: Fiscal Year Calendar: July 2025 to June 2026

- UMFlint Academic Calendar 2025: A Comprehensive Guide

- November 2025 Horse Calendar

- How To Buy Countryfile Calendar 2025: A Comprehensive Guide

- Miami-Dade Public Schools (M-DCPS) Calendar 2025-2026: A Comprehensive Overview

- Table Calendar 2025 Printable: A Comprehensive Guide To Design, Customization, And Printing

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Fiscal Year Calendar: July 2025 to June 2026. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Fiscal Year Calendar: July 2025 to June 2026

Fiscal Year Calendar: July 2025 to June 2026

Introduction

A fiscal year (FY) is a 12-month period used by businesses, governments, and other organizations to track their financial activities. Unlike the calendar year, which runs from January 1 to December 31, a fiscal year can start and end on any date. Many organizations choose to use a fiscal year that aligns with their business cycle or industry practices.

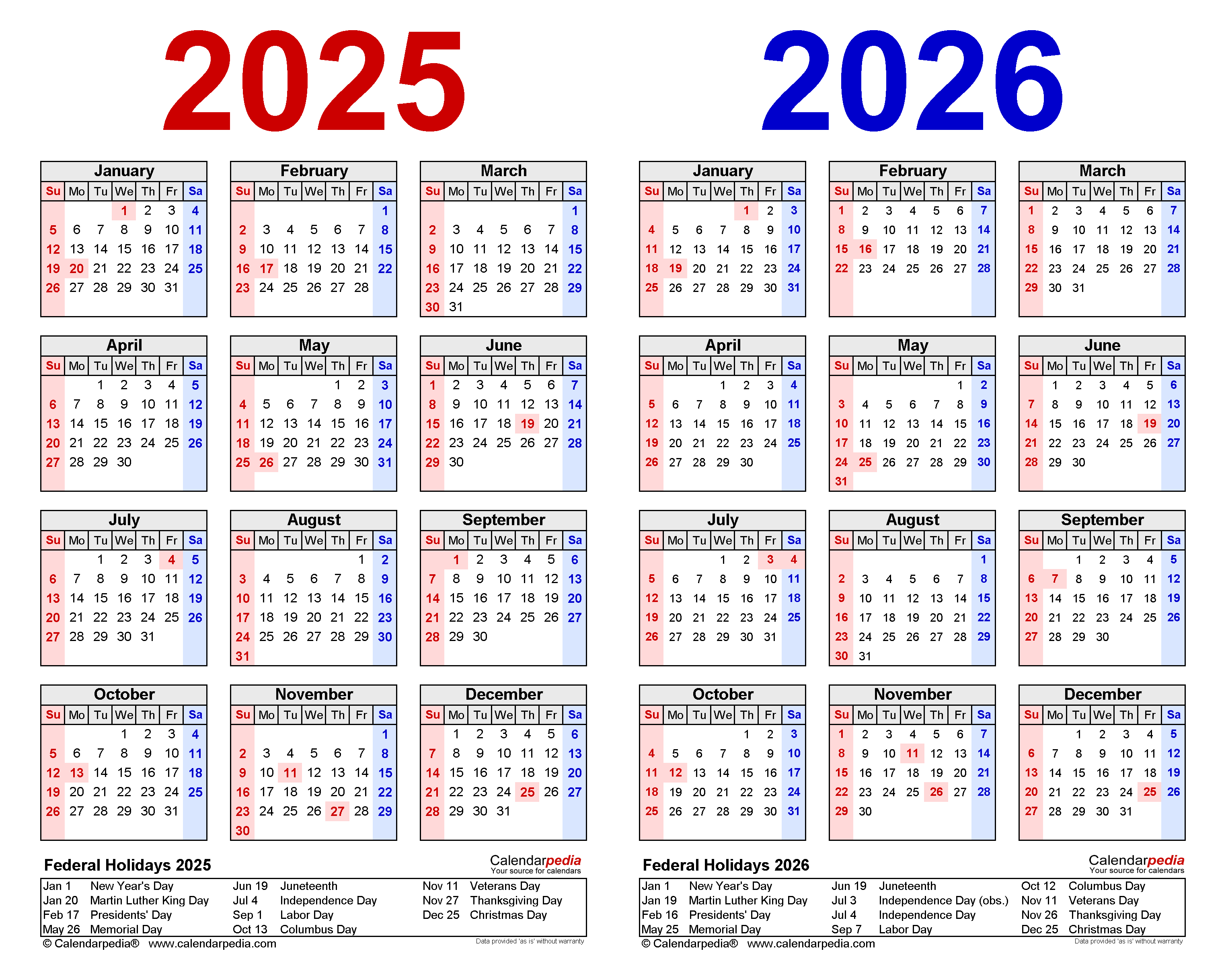

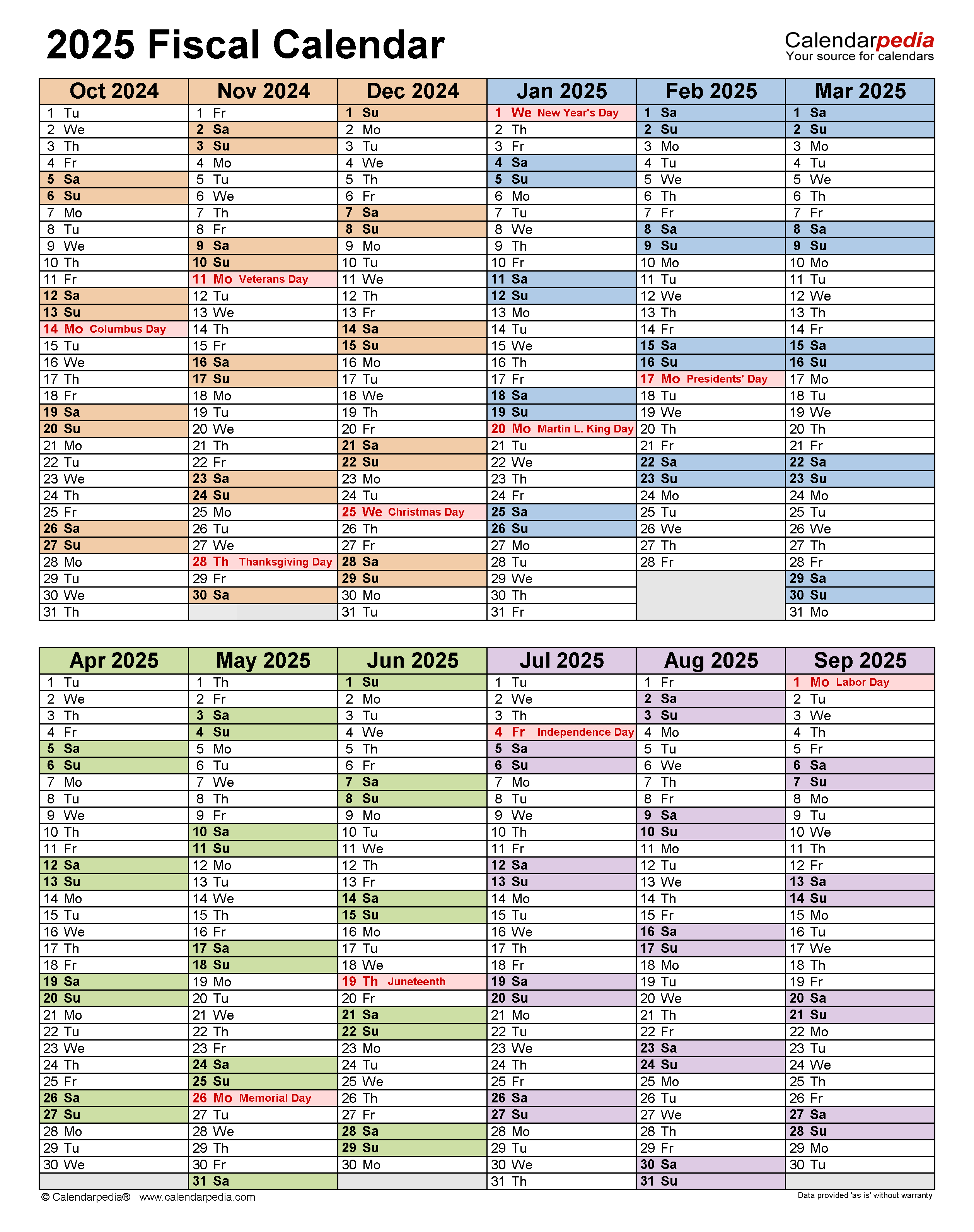

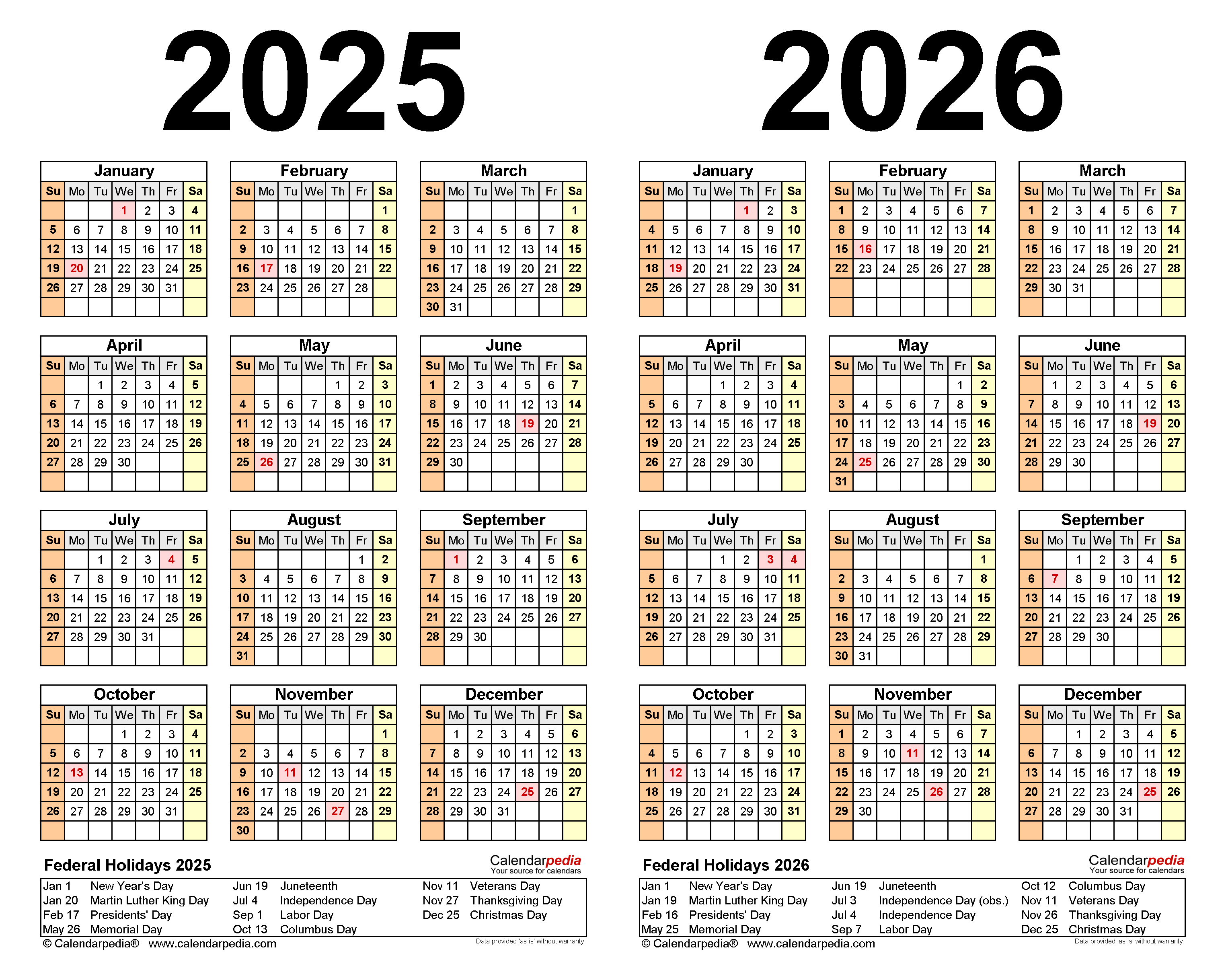

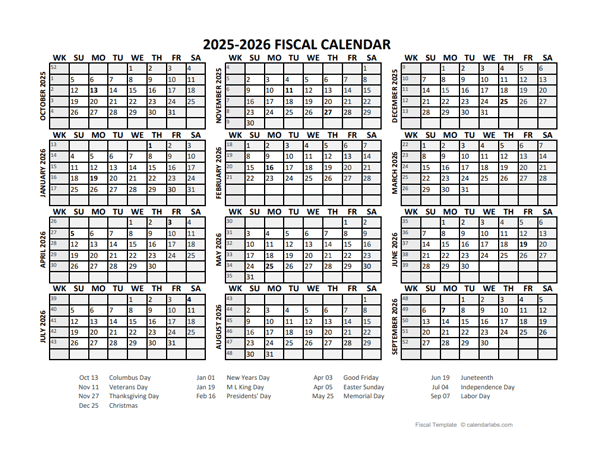

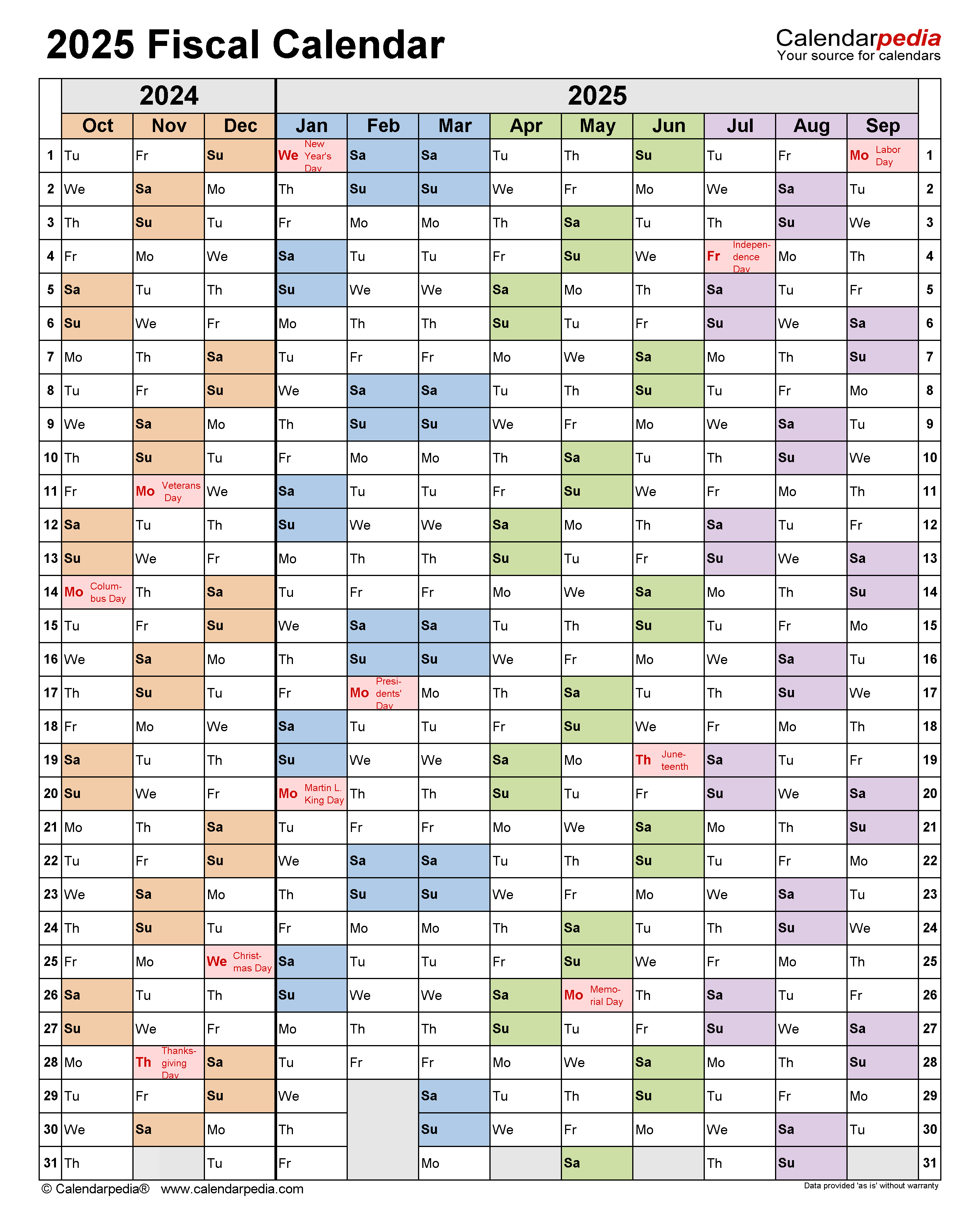

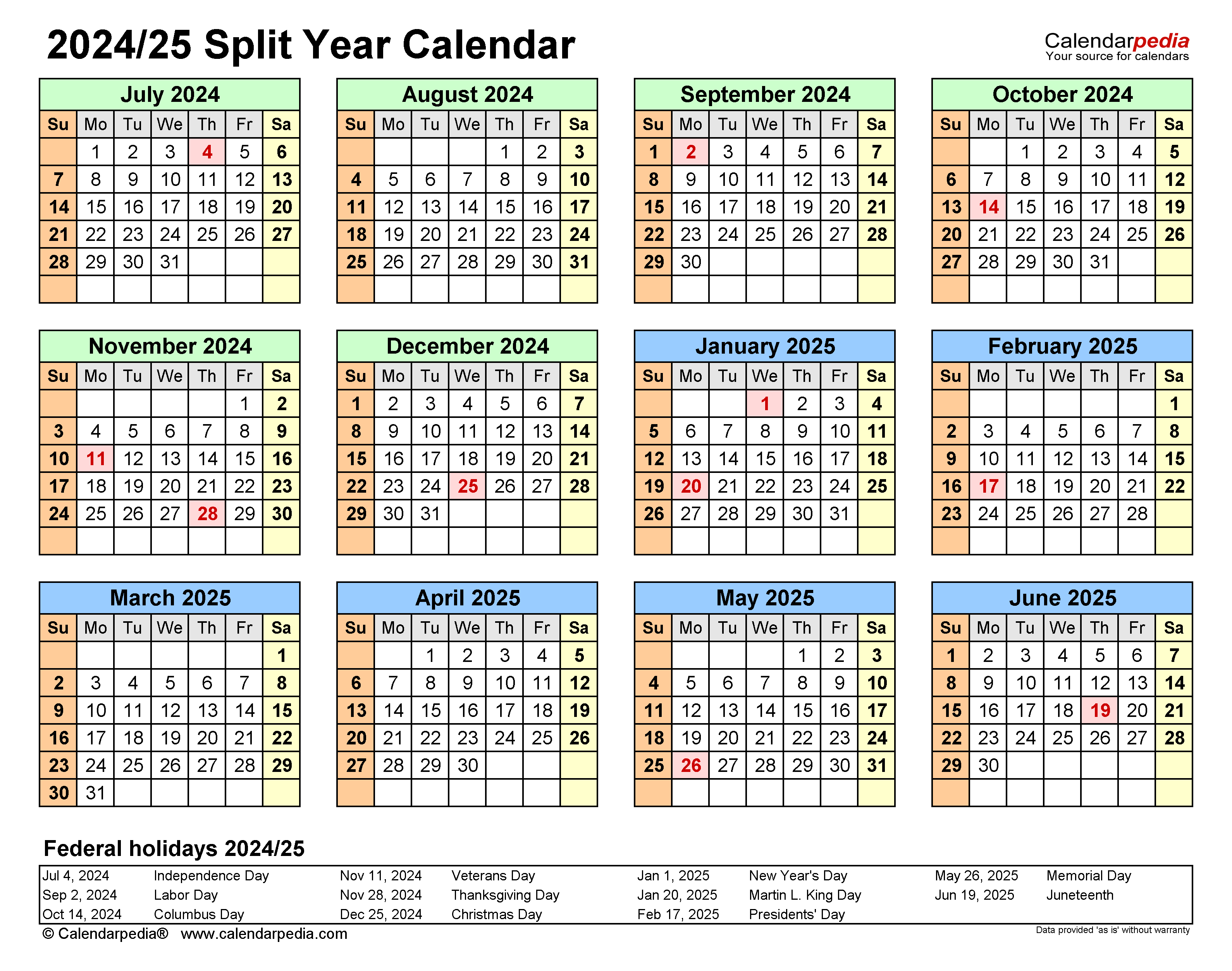

July 2025 to June 2026 Fiscal Year Calendar

The fiscal year from July 2025 to June 2026 is a 365-day period that begins on July 1, 2025, and ends on June 30, 2026. This fiscal year consists of 12 months, each with 30 or 31 days.

Months and Days

| Month | Days |

|---|---|

| July | 31 |

| August | 31 |

| September | 30 |

| October | 31 |

| November | 30 |

| December | 31 |

| January | 31 |

| February | 28 |

| March | 31 |

| April | 30 |

| May | 31 |

| June | 30 |

Key Dates

Some key dates within the July 2025 to June 2026 fiscal year include:

- July 1, 2025: Start of the fiscal year

- December 31, 2025: End of the first half of the fiscal year

- June 30, 2026: End of the fiscal year

Advantages of Using a July to June Fiscal Year

There are several advantages to using a fiscal year that runs from July to June:

- Alignment with business cycle: Many businesses have a natural business cycle that peaks in the summer months. A July to June fiscal year allows them to track their financial performance during this peak period.

- Tax planning: Some businesses may find it beneficial to have their fiscal year end before the April 15 tax filing deadline. This can provide them with additional time to prepare and file their taxes.

- Seasonal adjustments: A July to June fiscal year can help businesses account for seasonal fluctuations in their revenue and expenses.

Disadvantages of Using a July to June Fiscal Year

There are also some potential disadvantages to using a July to June fiscal year:

- Non-alignment with calendar year: A July to June fiscal year does not align with the calendar year, which can make it more difficult to compare financial data with other organizations or government agencies.

- Conflicting deadlines: The fiscal year end may conflict with other important deadlines, such as the end of the federal fiscal year on September 30.

- Tax implications: Businesses that switch to a July to June fiscal year may need to make adjustments to their tax reporting and filing.

Conclusion

The July 2025 to June 2026 fiscal year is a 365-day period that begins on July 1, 2025, and ends on June 30, 2026. There are several advantages and disadvantages to using a fiscal year that runs from July to June. Businesses should carefully consider their specific circumstances and needs before deciding whether to adopt this type of fiscal year.

Closure

Thus, we hope this article has provided valuable insights into Fiscal Year Calendar: July 2025 to June 2026. We hope you find this article informative and beneficial. See you in our next article!